- The Phenom Crypto Letter

- Posts

- WEEKLY UPDATE: Macro Signals to Watch this Month

WEEKLY UPDATE: Macro Signals to Watch this Month

Plus FTX/SEC Drama and a dive into the yield curve

THE PHENOM CRYPTO LETTER

GM,

Welcome to this week's edition of the Phenom Weekly Update—your go-to spot for the latest and greatest (or not-so-great) happenings in the world of digital currencies. Whether you're riding the Bitcoin rollercoaster, keeping your eye on altcoins, or just here for the memes, we've got you covered. Read on for the latest news and updates from the past week in crypto.

Here’s what we’ve got this week:

Macro Signals to Watch

FTX vs SEC (Again)

Whats Going on with the Yield Curve?

Jump to :

Macro Signals to Watch for in September

There are bunch of Macro Economic factors we should keep an eye on in September if we want the market to take off in Q4.

Sept 10 - US Presidential Debate: Crypto markets tend to get a little excited whenever Trump's election odds go up. This debate could shift the forecasts, so keep an eye on how it all plays out.

Sept 11 - CPI Data Release: Curious about how much more (or less) your groceries cost this month? A softer CPI means consumers are getting a break from inflation's tight grip. 🎉

Sept 12 - PPI Data Release: Wondering how much it costs to actually make stuff now? If PPI cools off, it’s a sign that producers aren’t feeling the need to jack up prices. 🛠️

Sept 18 - FOMC Meeting: Drumroll, please... The Fed might finally decide to cut rates. Lower borrowing costs = more spending. We're all rooting for a .25% rate cut here! 💸

Sept 20 - Unemployment Data: Are people getting jobs, or is the unemployment rate creeping up? We’ll know by the 20th.

What we are hoping for.

Slowing CPI & PPI inflation 📉

Flat unemployment numbers 👩💼👨💼

A 0.25% interest rate cut ✂️

Why? If these align, it means the Fed is cutting rates to boost an already stable economy (instead of desperately trying to rescue a sinking ship). Keep those fingers crossed! 🤞📈

🔍 FTX vs. SEC: The Battle Over Crypto Repayments! 🔍

Looks like the SEC isn't too thrilled about FTX’s latest idea—paying back its creditors using stablecoins and other cryptocurrencies. So, what's the drama about?

FTX’s Plan:

FTX, now bankrupt, is sitting on piles of crypto and thought, "Why not use this to pay people back?"

SEC Says: Not So Fast 💀

The SEC is warning FTX against using crypto (like stablecoins) to settle debts. Why?

Stability concerns: Stablecoins aren't as “stable” as they sound. We've seen some fail spectacularly (looking at you, Terra). 🌪️

Regulatory uncertainties: Crypto assets still don’t have the full legal framework that traditional currencies do. Imagine FTX repaying in a crypto asset, and it suddenly tanks—creditors would be left holding the bag. 🎒💸

The Bigger Picture:

The SEC claim they want to protect already-burned creditors from further risks. While stablecoins may be fine for trading, using them as a form of repayment raises all kinds of red flags. 🚩

What Happens Now?

FTX needs a Plan B—and fast. If the SEC steps in, they’ll likely force repayments in traditional currencies, making it harder for FTX to dig out of this hole. 🕳️

Our Take: FTX’s creditors might want their payouts ASAP, but the SEC isn't letting crypto-based repayments fly without a fight. It’s another twist in the ongoing FTX saga. A lot of FTX creditors want their payment In-Kind (they want the crypto assets not cash) but the SEC continues to “protect investors” by enforcement rather than simply providing a legal framework for crypto. Lets not forget that the SEC was all buddy buddy with FTX, the very type of company they should* be protecting investors from.

📉 The Yield Curve: It’s Not What You Think (Or Maybe It Is?)

Okay, so let’s dive deeper into this whole “yield curve” mess. If you’re not an economics nerd, let me break it down for you. Spoiler alert: things might not be looking so great.

What’s the Yield Curve Again?

Think of it like this: the yield curve is essentially a graph that shows interest rates over different lengths of time. It’s like a report card for the economy.

Normal yield curve: Longer-term bonds (loans) should pay higher interest than short-term ones because, duh, you’re lending money for a longer time and deserve a bigger reward, right?

Inverted yield curve: Uh-oh, this is when short-term bonds are paying more than long-term ones. It’s basically the economy’s way of saying, “Hey, something’s fishy here,” and historically it’s been a great predictor of a future recession. You know, like a giant blinking neon sign that says “TROUBLE AHEAD!” 🚨

But here’s the twist: after being inverted for quite some time, the yield curve just flipped back, or what fancy finance folks call dis-inverted. Woohoo, right? Actually...not so much.

So Why Should You Care?

Here’s where things get fun (well, sort of). Typically, after a yield curve inverts, and then goes back to normal, we see bad things happening to the economy. It’s like when you think you’re over a flu, but suddenly it turns into something worse. 😷

Past trends: Every time this “dis-inversion” happens, growth slows way down and a recession tends to follow.

Credit crunch: When short-term rates drop below long-term ones again, it usually means businesses and consumers are struggling to get loans because credit markets are super tight. And you know what that leads to: less spending, slower growth, job losses… yay. 😑

What Now?

Basically, we’re heading into a rough patch, and historically, when this happens, it’s not just a little dip in the road. It’s more like a pothole that’ll make you spill your coffee all over yourself. Expect tougher financial conditions and possibly some economic pain. 🫠

The Bottom Line:

It’s not the inverted yield curve that should freak you out, it’s when it flips back. The economy’s probably about to hit the brakes, and we might not like the view from here. Buckle up, folks—it may be a bumpy ride!

READING CORNER

A collection of longer form content we are consuming this week

AI Agents will use crypto

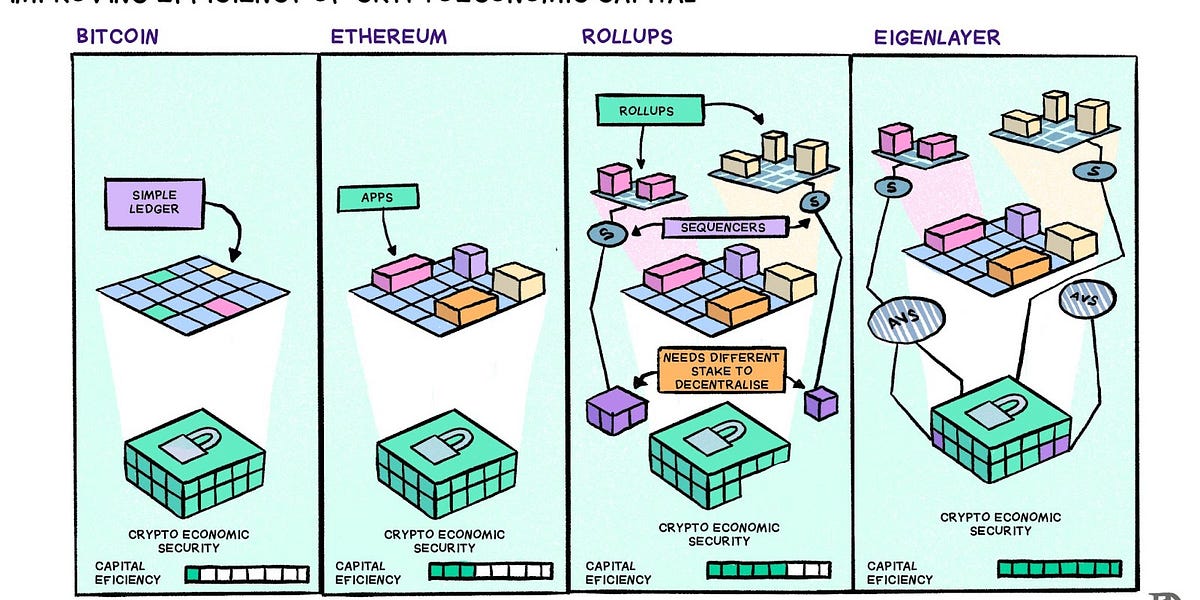

EigenLayer - Pushing the boundaries of trust

A quick overview on how Layer 2’s work

BLOCKBUZZ

Quick Hitters from the week

Trump Family's DeFi Project Aims to Protect US Dollar Dominance: World Liberty Financial teases a potential collaboration with Aave, indicating the project may be built on Ethereum.

Swiss Bank ZKB Launches Bitcoin and Ether Trading: Zurich Cantonal Bank (ZKB) introduces secure Bitcoin and Ether trading, with private key storage handled by the bank.

Cantor Fitzgerald CEO: TradFi Companies Want to Transact in Bitcoin: Howard Lutnick, recently appointed by Donald Trump to chair his transition team, highlights growing interest from traditional finance firms in Bitcoin.

FBI Issues Warning on North Korean Hackers Targeting US Crypto ETFs: North Korean hackers are attempting to steal crypto funds from U.S.-based ETFs using advanced social engineering tactics, according to the FBI.

Crypto.com Partners with Standard Chartered: Collaborates with the major bank to expand global fiat services.

OpenSea Receives SEC Wells Notice: SEC classifies NFTs sold on the platform as securities, prompting OpenSea's CEO to express shock at the move against creators and artists.

Telegram CEO Durov Indicted in France: Pavel Durov is now under supervision in France following an indictment, facing legal challenges in the country.

THE TWITTERVERSE

A collection of the most interesting stuff on Crypto Twitter this week

Crypto is money for AI

Ethereum is a property rights system for machines.

Humans first, yes.

But bots will be the main users.

You think an AI agent can walk into a bank branch an open an account? Ethereum will bank the unbanked.

The machines will be bankless.

— RYAN SΞAN ADAMS - rsa.eth 🦄 (@RyanSAdams)

4:54 PM • Sep 5, 2024

A thread analyzing where $ETH went wrong and why its effecting price action

I think in hindsight $ETH went wrong in a few places:

1. Focusing on 'sound money' principles too much and messing around with tokenomics. Way more time and effort should have been placed on scaling the L1, making txns faster and cheap - the rise of Solana literally proves this.… x.com/i/web/status/1…

— Picolas Cage (@Picolas_Caged)

8:34 PM • Aug 30, 2024

In depth thread on crypto narratives

I've been closely following the evolving narratives in the crypto space this year, and I wanted to share my thoughts on how things have shifted since January.

It's fascinating to see how certain themes have gained traction while others have faded into the background.

A… x.com/i/web/status/1…

— arndxt (@arndxt_xo)

2:39 AM • Aug 23, 2024

WAGMI

For the (crypto) Culture

just a friendly reminder:

— wallstreetbets (@wallstreetbets)

2:00 PM • Sep 4, 2024

You made it to the bottom. That’s awesome. If you enjoyed reading the letter please do us a favor and give us some feedback or share it with your friends. It helps us keep bringing you great content every week!

How'd we do this week?Don't be shy! Click an option below or respond to this email if you have any suggestions. |

📣 Share with your friends and get free stuff! 📣

If you like Phenom Crypto maybe someone you know would as well.

As a way to say thank you in case you refer someone, we’ve built a referral program. Check out our current reward milestones below!

Thanks for reading!

If you aren’t subscribe and like what you read, do us a huge favor and hit the button below!

Tired of our content? Unsubscribe w/ one click below

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

Reply